Future of Video: Three Takeaways for Content Producers

This month, I spoke at Parks Associates’ inaugural Future of Video Conference on the ‘Distribution Opportunities and Challenges for Content Producers’ panel.

We had a lively exchange of ideas centered around the complexities facing content producers, ways to balance established and new video distribution avenues, and strategies for companies to drive growth in the changing video landscape.

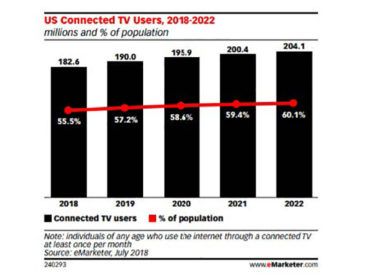

The skyrocketing growth of streaming audiences demands content producers embrace new formats and types of video. According to Nielsen’s latest OTT TV report, Americans collectively spend nearly 8 billion hours per month consuming content on connected TV devices.

With the advent of new distribution channels and direct-to-consumer options upturning established windowing strategies and partnerships, content producers must evolve and remove their legacy mindset to capitalize on the new opportunities for distributing and monetizing content.

Here are key takeaways from our panel:

Should programmers create niche versus general market content?

Our panelists agreed that OTT services need to fall into either niche or general market content categories. But without the deep-pocketed resources of the streaming giants (Amazon, Netflix and soon to launch Disney and AT&T’s WarnerMedia), content companies will have a difficult time competing in the general market space. Instead, there are tremendous growth opportunities for niche players in the booming ad-supported OTT market. Pure-play and niche OTT networks, such as MLB.TV, Newsy and Tubi TV, are gaining significant traction with attracting growing audiences. Cutting through the competition is one of the big challenges for niche OTT services, so picking the right genre, focusing on the right audiences and have a clear brand proposition will be the key to success.

Where do programmers invest their resources?

The fundamental question content producers should be asking is: In what screen and in what transmission do we invest in? The easy answer is all screens, all the time, but that is an expensive gamble. With the increasing fragmentation of the OTT landscape, content owners are spending exorbitant amounts on app development. Only certain platforms have been able to recuperate that investment. Furthermore, ATSC 3.0 and 5G threaten today’s dominance of traditional cable, satellite, and internet delivery of high-quality video. The winner will likely be determined by proximity to the user (i.e. the device manufacturer like Apple) or the success of bundled services (e.g. AT&T pairing content with a 5G plan).

Consolidation: Do you join forces and with whom?

The rise of mega-mergers is driving more competition with OTT streamers. According to Ampere Analysis, four of every $10 in the United States will be accounted for by Comcast/Sky and Disney/Fox. The growing consolidation will mean less competition for rights for small players and this inevitably impacts their ability to negotiate favorable deals. The cost of marketing services will continue to frustrate small to medium upstarts. As such, aggregators will serve an essential place in OTT’s future for both SVODs and AVODs.

In the end, personalization of both content and experience will be tantamount to success on all platforms. Consumers are the ultimate winners as competitive pressures will drive media companies to forego near-term profits to please users with fresh content on all screens at affordable costs. Someday in the future, consumers will need to shoulder the cost of their increased demands—limited to no-commercials and content delivery on every screen. But, let’s all enjoy the spoils of today’s content wars for now.